Payment Types

ACH Payment Types

ACH Charges (debits)

Any ACH transaction structured as an ACH debit "pulls" money from one account and moves it to another—such as from a consumer's personal account to that of a business or government agency.

The ACH network constantly takes in batches of push and pull requests from banks and their intermediaries. Then, five times per business day, the network sorts them into new bundles and delivers them accordingly. When a given request in one of those new batches asks that an account be debited some amount of money, that's an ACH debit request.

Of course, every transfer requires pulling money from someone’s account, meaning a debit is always happening on one side or the other. Whether it gets categorized as an ACH debit depends on who initiated the request. For most consumer billing scenarios, the Orignator - yep, that's you again - is the one initiating (or “originating”) the ACH request. And because that request is for the system to pull money, it's considered an ACH debit. If, instead, a consumer sends money as a one-off transfer from their online banking portal, they’re asking the network to "push" money for them. This means it’s not an ACH debit—despite money being debited from their account.

How does ACH debit work?

In an ACH debit transaction, one party agrees to pay another. To make that happen, the party receiving payment sends a message to the ACH network asking it to collect said payment and move the funds into their account.

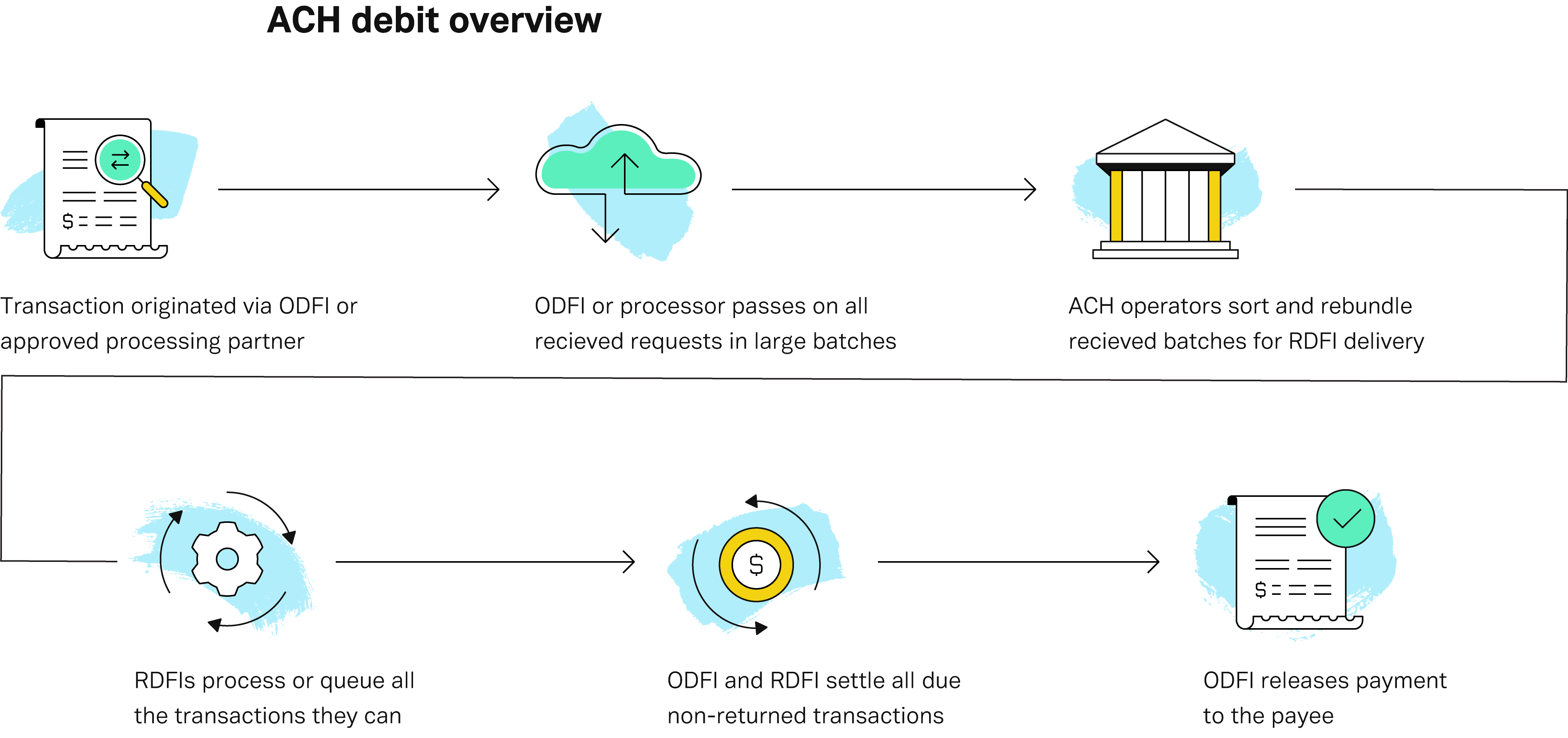

As for how ACH debits work mechanically:

- A Receiver (customer) enters into a agreement to make ongoing payments for regularly billed services such as life insurance, an auto loan payment, or a utility bill.

- The customer signs an authorization (can be paper or digital) agreeing to have their bank account automatically debited, rather than manually pay for each billing period.

- When it’s time to pay a bill, the Originator submits an ACH debit request through the ACHQ API. Once it’s sent to the ODFI, the ACH debit request instructs the ACH network to pull the requested funds from their customer’s account at the given time intervals.

- 5x per business day, the ACH network breaks down these incoming bundles into individual messages (each representing a transaction) and rebundles them for quick delivery to each Receiving Depository Financial Institution (RDFI).

- Each RDFI imports their mail into their system, executes or queues all the transactions, and sends back any error codes with their next regular batch of mail.

- If no error/return code is received by the requested settlement time, the ODFI and RDFI settle the transaction using their balances at the Fed.

- Funds for settled transactions are then released by ACHQ to your company account

ACH Payouts (credits)

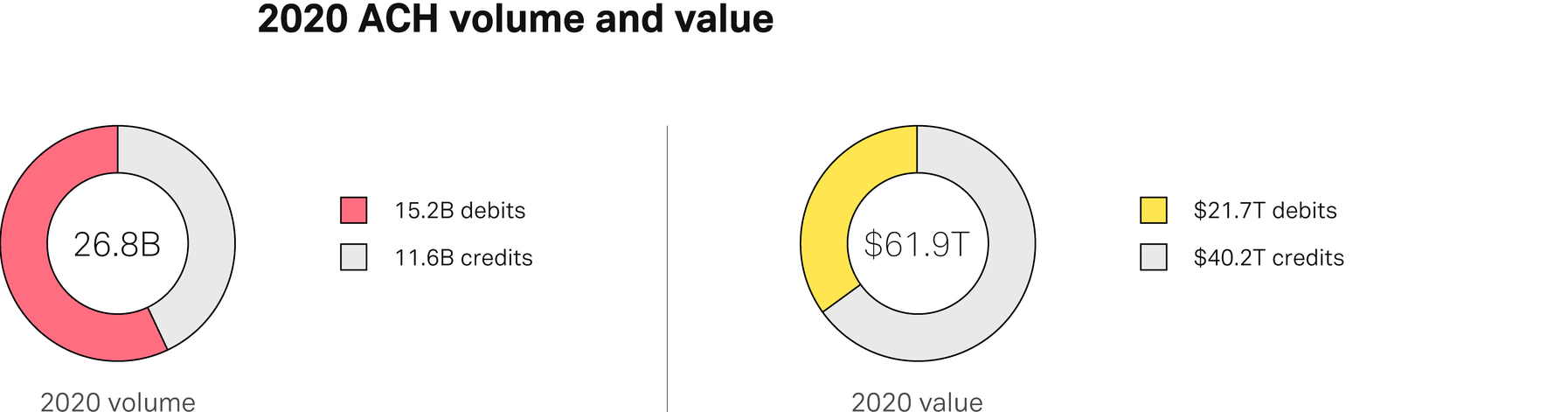

Most Americans receive an ACH credit two or three times a month without knowing they’ve done so. The ACH system is a great unsung part of America’s financial plumbing, and even frequent commercial ACH users can fall behind the pace of new solutions being built atop the underlying infrastructure.

Despite not being a household name, ACH credit payments are quietly ubiquitous. Often referred to by informal names matching popular uses cases (e.g., “direct deposit” and “peer-to-peer payment”), the ACH network powers tens of millions of credit transactions every day.

ACH payouts refers to the process of depositing, or “pushing,” funds digitally into a bank account using ACH, an electronic payment processing network. In this way, ACH credit functions like a digital check sent from one party to another, minus the check.

How does a payout work?

Payroll offers a perfect example of how ACH credit works. Let’s say your employer, AmazingJob (the Originator, uses ACH to issue bi-monthly paychecks to employees (aka direct deposit). Here’s how ACH payout works in this case:

-

To begin, AmazingJob will confirm your bank account. HR might use ACHQ Account Insights, a service like Plaid, or even microdeposits

-

Twice monthly, AmazingJob will issue payment using ACH files. These files will include your name, bank account and routing numbers, and the amount of your paycheck after deductions. AmazingJob sends the ACH credit files to ACHQ who partners with the Originating Depository Financial Institution (or ODFI)—this bank originates the payment.

-

Then, the ODFI will compile and batch process the ACH files received that day. Once this is completed, the files are sent to one of two clearinghouses—the Federal Reserve or EPN (the Electronic Payments Network).

-

The next business day, the clearinghouse will sort ACH transactions and submit them to the right bank. At this point, your bank will get the ACH credit request from AmazingJob’s bank. Your bank, in this case, is the Receiving Depository Financial Institution, or RDFI, since they received the ACH credit request from the ODFI.

-

When it receives the ACH files, your bank will deposit your paycheck, placing the funds in a “Settlement Account.” Inside your account, these funds will likely appear as “Pending.”

-

The payment will settle once the ACH credit has been cleared by the clearinghouse. At this point, you will have full access to money from your AmazingJob paycheck.

What is the difference between a payout and a charge?

The difference between a payout and a charge is based on the direction money moves. An ACH credit deposits (or pushes) funds into a bank account. An ACH debit withdraws (or pulls) funds from an account.

Understanding the meaning of ACH credit (vs. ACH debit) can be initially confusing for consumers who use credit and debit cards for an identical purpose—to make payments. The best way to remember the difference is that, in each case, funds flow in opposing directions

Updated 11 months ago